IMG Pro Manual

Your comprehensive guide to the IMG Pro indicator — the ultimate time-saving tool for ICT-based price action trading.

Introduction to IMG Pro

The IMG Pro indicator automates the "heavy lifting" of technical analysis, designed specifically for traders following Trader Mayne's price action system. It serves as a personal assistant that:

- Identifies HTF POIs: Automatically marks Higher Timeframe Points of Interest like Order Blocks, Breakers, and Fair Value Gaps.

- Detects Setups: Alerts you to high-probability trade setups at these key levels (e.g., SFP + MSB).

- Manages Risk: Instantly calculates position sizes, entry prices, stops, and targets based on your account settings.

The system is built to support a Top-Down Analysis approach, ensuring you are always aligned with the higher timeframe structure before taking lower timeframe entries.

Indicator Tiers

Choose the tier that fits your trading needs. Each tier builds upon the previous one.

- HTF Structure: Visualizes Market Structure Ranges on Higher Timeframes.

- Key POIs: Automatically plots Order Blocks (OBs) and Breakers.

- Alerts: Notifies you of HTF Market Structure Breaks (MSB).

- Everything in Basic, plus:

- More POIs: Adds Fair Value Gaps (FVGs).

- Trade Alerts: Signals setups at HTF Extremes and enabled POIs.

- Risk Calc: Automatic Position Sizing and Risk Management tools.

- Exits: Fixed Risk-to-Reward (R:R) exit modules.

- Everything in Lite, plus:

- Extended POIs: Option to extend untested HTF POIs forward.

- Fluid Exits: Dynamic exits based on opposite signals.

- Risk Control: Customisable Maximum Trade Risk settings.

- OB + FVG Overlaps

- Breaker + FVG Overlaps

- Internal Liquidity Levels

- ALL Trade Setups (Trend & Counter-Trend)

- 5 Entry Modes & 4 Exit Modes

- Early Warning Systems

- Automated Backtesting System

- Trend Filter Companion

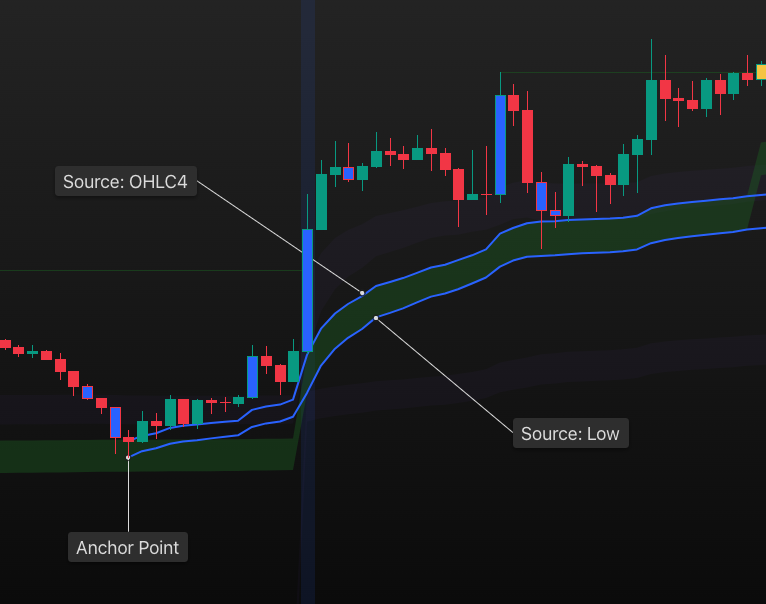

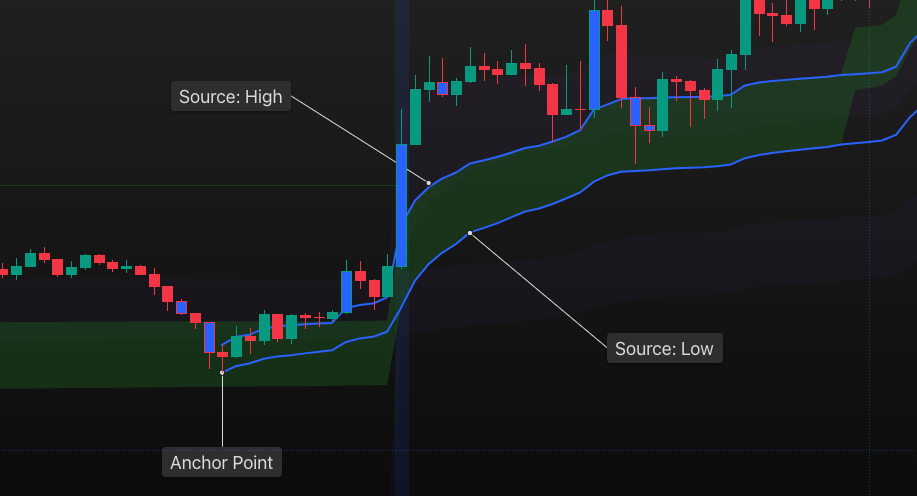

- Auto Anchored VWAP

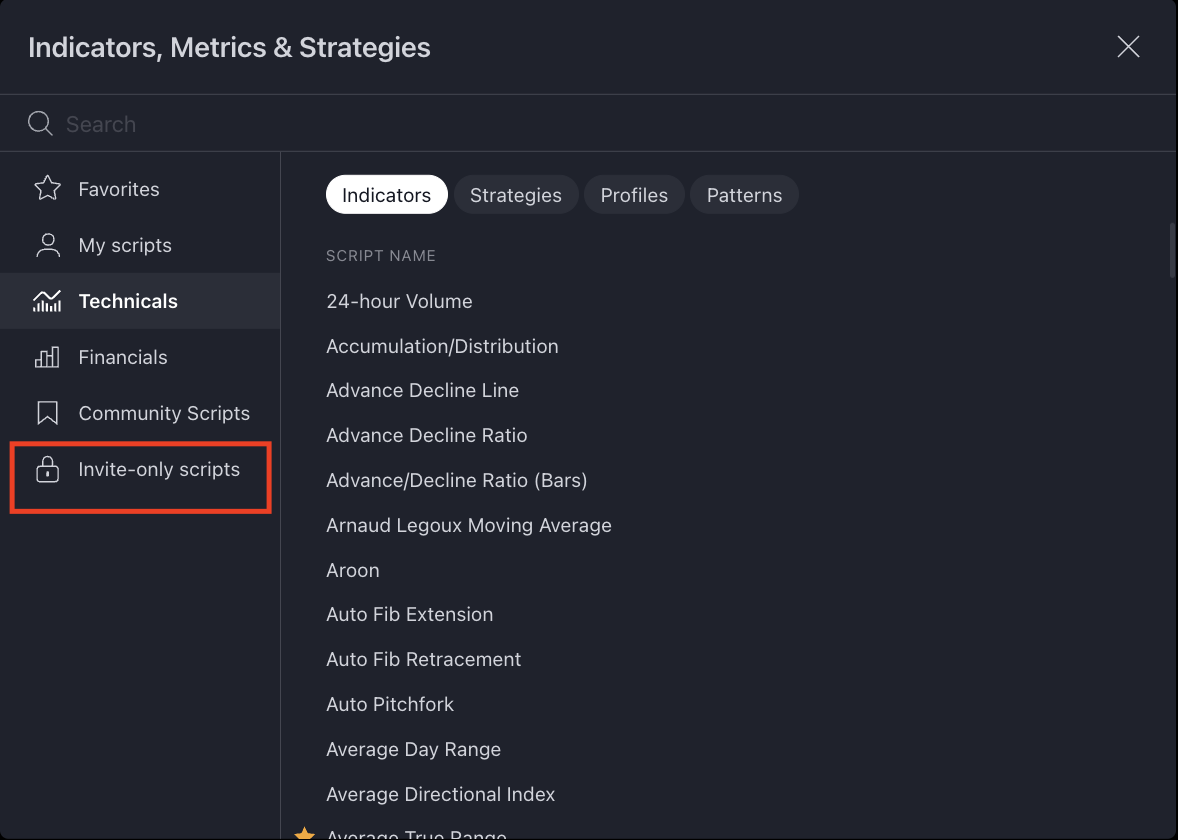

System Access

How to Get Started

-

Create an account at IMGPro.ai.

Prefer to pay with Crypto? DM aj_img on Discord.

- Select the product tier that suits your trading style.

- Subscribe to activate your license (access usually within 24 hours).

- Locate the indicators in TradingView under Indicators > Invite-only scripts.

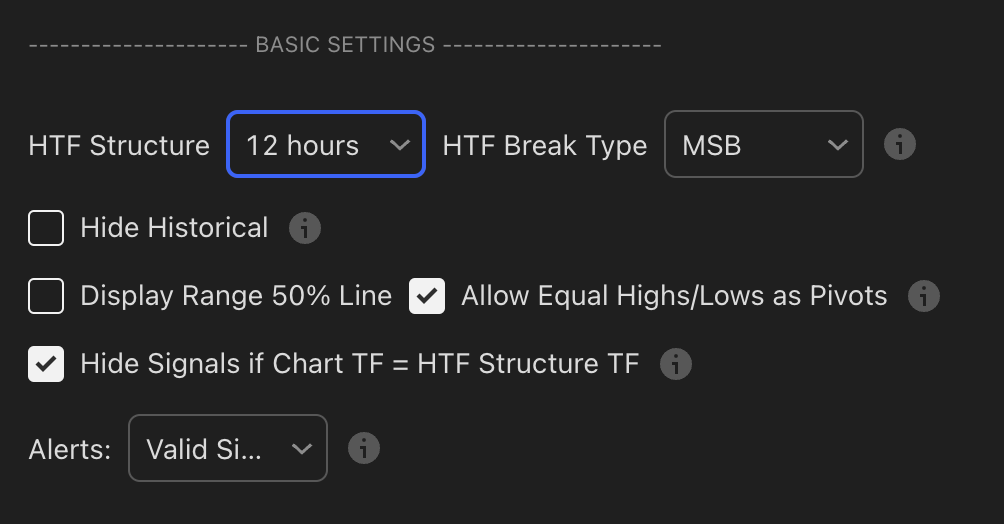

Basic Settings

The Basic Settings panel is your "Control Centre" for the entire system. Here, you define the Higher Timeframe (HTF) foundation that the rest of the indicator builds upon.

HTF Structure

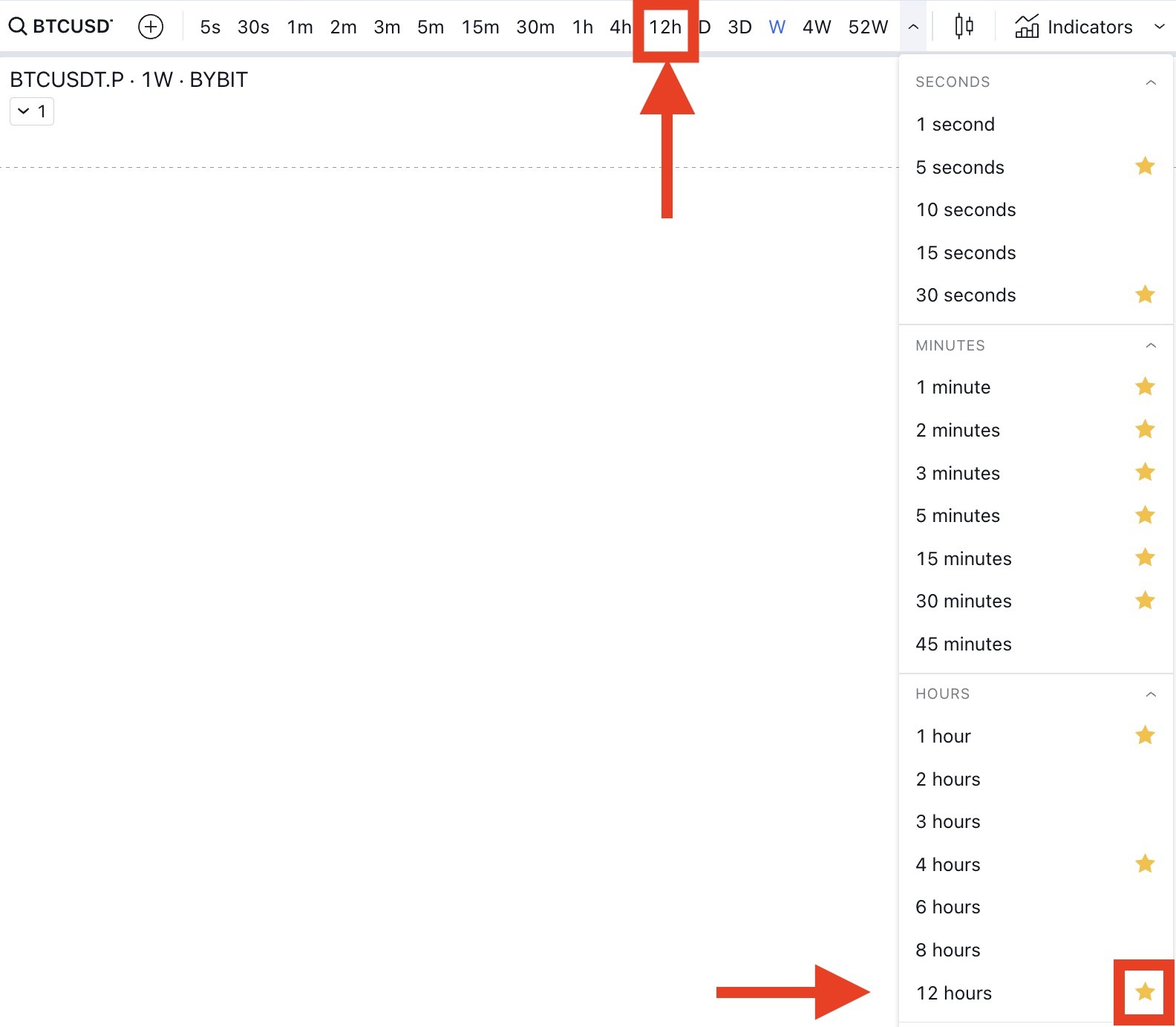

How to Configure

- Open the indicator settings.

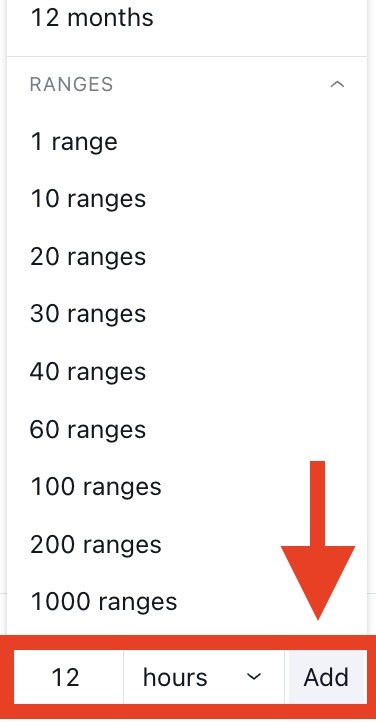

- Locate the HTF Structure dropdown at the top.

- Select your desired timeframe (e.g., 4h, 12h, D, W).

Description

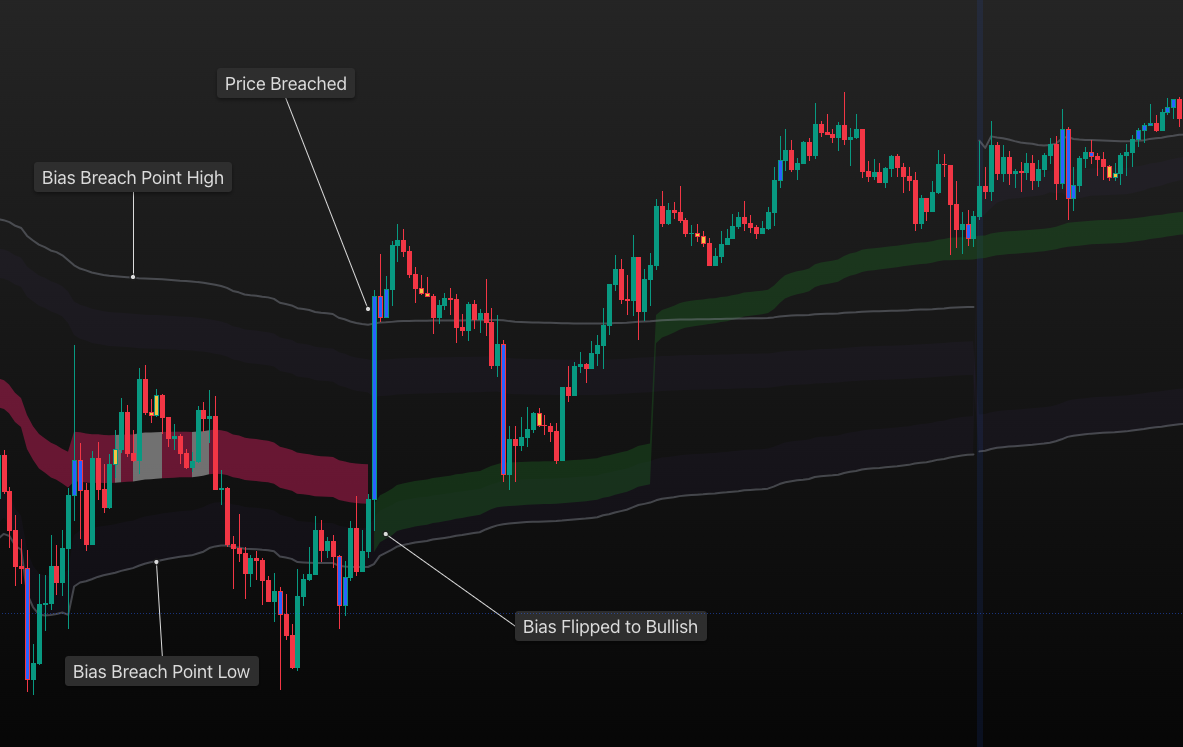

This setting determines the Market Structure (MS) and Points of Interest (POIs) displayed on your chart. The indicator will map the Highs, Lows, and Trend Bias of this selected Higher Timeframe onto your current chart.

- Bullish Bias: Displayed as Green structure lines.

- Bearish Bias: Displayed as Red structure lines.

Example: H12 Market Structure overlaid on an H1 Chart. View Live Chart Example

.png)

HTF Break Type

Break Type Options

This setting defines how the indicator confirms a Break of Structure (BOS) or Market Structure Shift (MSS).

The standard, conservative approach. A break is only confirmed when a candle CLOSES beyond the key pivot level.

- Bearish Break: Candle body closes below the previous Higher Low.

- Bullish Break: Candle body closes above the previous Lower High.

.png)

These modes represent a more aggressive approach to structure breaks. While they still require a candle CLOSES to confirm valid structure breaks, they validate breaks based on more sensitive internal pivot levels rather than major swing points.

These modes represent a more aggressive approach to structure breaks. While they still require a candle CLOSES to confirm valid structure breaks, they validate breaks based on more sensitive internal pivot levels rather than major swing points.

First Opposite Pivot (MSS)

A aggressive approach that identifies new structure points immediately after a break:

- Bearish Structure: High is the first opposite 3-bar pivot high after the break.

- Bullish Structure: Low is the first opposite 3-bar pivot low after the break.

.png)

Closest Opposite Pivot (MSS)

Very aggressive. Uses the closest unbroken pivot point:

- Bearish Structure: High is the closest unbroken opposite 3-bar pivot high to price.

- Bullish Structure: Low is the closest unbroken opposite 3-bar pivot low to price.

.png)

Closest Pivot (MSS)

Extremely aggressive. Applies logic to both sides of the range:

- Bearish: High & Low are the closest unbroken opposite 3-bar pivots.

- Bullish: High & Low are the closest unbroken opposite 3-bar pivots.

.png)

Hide Historical

Clear the Clutter

This toggle allows you to focus solely on the current Market Structure.

- ON: Only the active High, Low, and MSB/POI levels are visible. Old levels are hidden.

- OFF: All historical structure breaks and levels remain visible for backtesting.

.png)

.png)

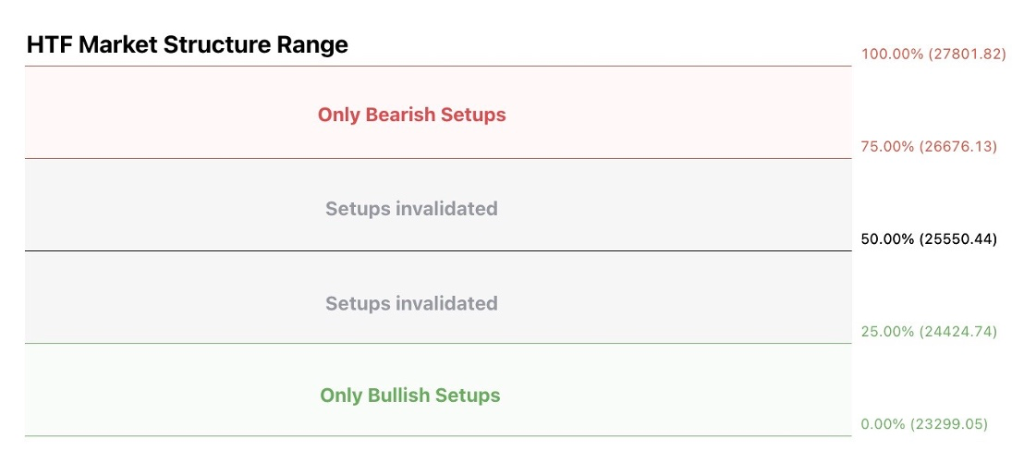

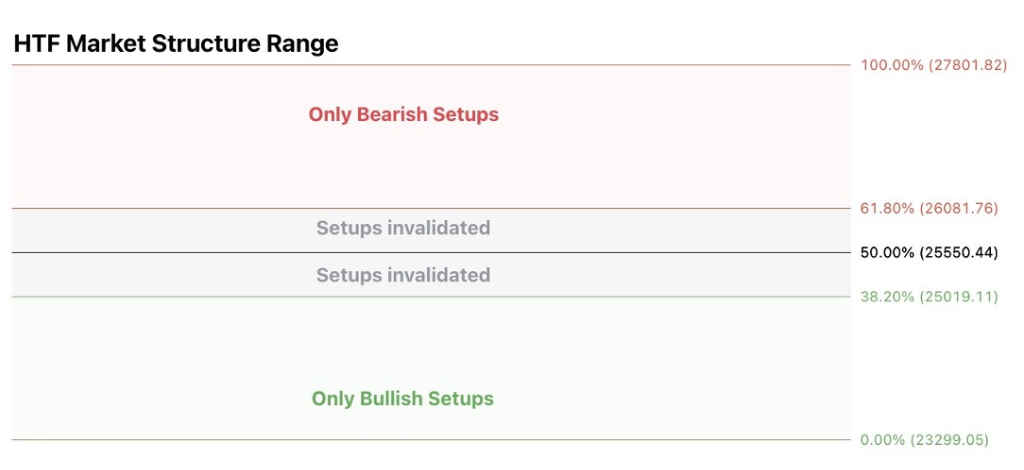

Display 50% Range Line

Equilibrium (EQ)

This toggle displays a dashed line at the exact midpoint (50%) of the current trading range.

.png)

Equal Highs / Lows as Pivots

Handling Equal Extremes

Sometimes price hits consecutive levels that are nearly identical. This setting helps the indicator recognize these "Double Tops" or "Double Bottoms" as valid pivot points.

Chart TF and Alerts

Managing Signals & Alerts

Alert Configuration Modes

Select how you want the indicator to trigger TradingView alerts:

1. ALL

Triggers an alert for EVERY event: Trade Setups, Stop Losses, Take Profits, Invalidations, etc. Good for logging but can be noisy.

2. Valid Signals Only

(Recommended) Triggers alerts ONLY for triggered trade setups and their associated TP/SL levels. Filters out invalid setups.

Backtest Settings

.png)

Configuration

| Setting | Description |

|---|---|

| Table Size | Adjusts the size of the results table on your chart (Small, Normal, Large). |

| Disable Backtester | Turn OFF to improve chart loading speed if you are not currently backtesting. |

| Custom Start Date | Define a specific starting point for the backtest (e.g., "2023-01-01"). Useful for testing specific market conditions. |

Backtest Results Metrics

| Metric | Description |

|---|---|

| Initial Capital | Your starting account balance. (Tip: Set this to your ACTUAL account size). |

| Available Capital | Current capital based on closed trades only. |

| Net Profit | Total Profit/Loss realized over the test period. |

| Closed Trades | Total number of completed trades. |

| Win Rate | Percentage of trades that ended in profit. |

| Max Drawdown | The largest peak-to-valley drop in equity. High = High Risk. |

| Profit Factor | Gross Profit / Gross Loss. (> 1.5 is ideal). |

| Max Win / Max Loss | The single largest winning and losing trades in the period. |

| Avg Trade Win/Loss | The average P&L per trade. |

| Buy and Hold P&L | Comparison: Profit if you just bought and held the asset vs. trading it. |

| Outperform | How much the strategy beat (or lost to) Buy & Hold. |

Interpreting Results (Color Coding)

The table uses color coding to highlight strategy health, specifically tailored for Prop Firm conditions (High Profit Factor + Low Drawdown).

Max Drawdown (DD)

| DD < 10% | Good |

| DD 10-15% | Caution |

| DD > 15% | High Risk |

Profit Factor (PF)

| PF < 1 | Unprofitable |

| PF 1 - 1.5 | Moderate |

| PF > 1.5 | Strong |

Example Result:

.png)

Higher Timeframe (HTF) Points of Interest (POIs)

.png)

POI 1: HTF Order Blocks

How to Configure

- Open the indicator settings.

- Navigate to the Higher Timeframe (HTF) Points of Interest (POIs) section.

- Locate POI 1 and select HTF Order Blocks from the dropdown menu.

Description

An Order Block (OB) is identified as the last opposite candle to print before a confirmed Market Structure Break. It represents the "footprint" of institutional buying or selling.

- Bullish OB: The last down candle before a bullish Structure Break.

- Bearish OB: The last up candle before a bearish Structure Break.

Example: The H12 Order Block is identified on the left and then projected onto the H1 chart on the right. View Live Chart Example

.png)

Configuration Options

| Option | Function |

|---|---|

| OB Only | Displays all valid Order Blocks derived from the HTF Structure. |

| OB + FVG | Filters results to only show Order Blocks that overlap with a Fair Value Gap (FVG). This is a higher probability confluence. |

| Extend Toggle | When enabled, untested OBs extend to the right until price tests them. |

Invalidation Rules

If "Use HTF Close Through to Invalidate" is enabled (see Settings), stricter rules apply:

- Invalidation: The POI is considered failed if the HTF candle closes completely through the block.

- Wicks: A wick through the block does not invalidate it (limit orders may still trigger).

POI 2: HTF Breaker Blocks

How to Configure

- Open the indicator settings.

- Navigate to POI 2 in the HTF Points of Interest section.

- Select HTF Breaker Blocks from the dropdown.

Description

A Breaker Block is essentially a "failed" Order Block. It is an Order Block that price has impulsively broken through, confirming a shift in market structure. When price returns to test this level, it often acts as strong support or resistance.

- Bullish Breaker: A bearish Order Block (up candle) that price smashed UP through.

- Bearish Breaker: A bullish Order Block (down candle) that price smashed DOWN through.

Example: A bearish H12 Order Block fails and converts into a constant Bullish H12 Breaker on this H1 chart. View Live Chart Example

.png)

Configuration Options

| Option | Function |

|---|---|

| Breaker Only | Displays all valid Breaker Blocks. |

| Breaker + FVG | (Recommended) Filters results to only show Breakers that overlap with a Fair Value Gap. |

| Extend Toggle | Stretches the Breaker zone to the right until it is tested by price. |

Invalidation Rules

Similar to Order Blocks, Breakers remain valid as long as the HTF Structure is intact. However, if HTF Close Through is enabled:

POI 3: HTF Fair Value Gaps (FVGs)

How to Configure

- Open the indicator settings.

- Navigate to POI 3 in the HTF Points of Interest section.

- Toggle Show HTF Fair Value Gaps to ON.

Description

A Fair Value Gap (FVG) is a price range where one-sided buying or selling occurred, creating an imbalance. Market theory suggests price often returns to these gaps to "rebalance" the auction.

- Bullish FVG: Created by a large green candle. The Low of the 3rd candle is higher than the High of the 1st candle.

- Bearish FVG: Created by a large red candle. The High of the 3rd candle is lower than the Low of the 1st candle.

Example: An H12 FVG is identified on the left and projected onto the H1 chart on the right. View Live Chart Example

.png)

Configuration Options

| Option | Function |

|---|---|

| Display Logic | FVGs are structure-agnostic. Both bullish and bearish FVGs from the HTF are displayed if enabled. |

| Confluence Filter | Note: Standalone FVGs will NOT display if they are already part of an OB+FVG or Breaker+FVG (if POI 1 or POI 2 is enabled). This prevents chart clutter. |

| Extend Toggle | When enabled, the FVG zone extends to the right until it is completely filled (price touches the other side). |

Invalidation Rules

POI 4: HTF Internal Pivots (Display Only)

How to Configure

- Open the indicator settings.

- Navigate to POI 4.

- Toggle Liquidity Levels to ON.

Description

This feature displays Untested Internal Pivots from the HTF structure. These are key liquidity/reaction levels within the current trading range.

- Function: Displays horizontal lines representing significant highs or lows within the active HTF Structural Range.

- Behavior: Lines extend to the right until price tests them (liquidity grab) OR the HTF Market Structure breaks (rendering the old range obsolete).

Example: Untested H12 pivots shown within an active H12 structure, displayed on an H1 chart. View Live Chart Example

.png)

HTF Close to Invalidate POIs

Configuration

| Setting | Description |

|---|---|

| Close Through Invalidation |

|

Description

This setting determines exactly when a Point of Interest (OB, Breaker, or FVG) is considered "broken" or invalid.

- Standard Behavior (Default): POIs generally remain valid as long as the HTF Structure itself is valid.

- With "Close Through" ENABLED: The system applies stricter criteria. If a HTF candle closes body-through the POI, that specific POI is immediately invalidated and removed from the chart, even if the overall structure hasn't broken.

Trade Setups

HTF-LTF Trade Setups at HTF POIs

.png)

Range Extremes & Old Untested

How to Configure

- Navigate to the Trade Setups section in settings.

- Locate Range Extremes.

- Toggle Show HTF SFPs and Show HTF-LTF Setups to ON.

Description

This section governs alerts and setups derived from the extremes (Highs and Lows) of the HTF Structural Range.

1. Market Structure Breaks (MSB)

2. HTF Swing Failure Patterns (SFP)

An SFP occurs when price sweeps a Range Extreme (takes liquidity) but fails to close beyond it, closing back inside the range. This indicates a potential reversal.

.png)

Detailed view of an SFP confirmation:

.png)

3. HTF-LTF Trade Setups

This is a high-probability reversal setup. It generates a signal when:

- A HTF SFP is confirmed at a Range Extreme.

- Followed explicitly by a LTF Market Structure Break (MSB) or Shift (MSS) in the opposite direction.

.png)

.png)

Old Untested Highs/Lows

When enabled, the system also monitors significant HTF highs and lows outside the current active range. These levels remain valid for SFPs and Setups until tested or broken.

HTF-LTF Setups at Liquidity

How to Configure

- Navigate to HTF-LTF Setups at Liquidity.

- Select your preferred Mode (At POIs, ALL, or ALL - With Structure).

- (Optional) Toggle HTF SFPs at Liquidity to see the SFP labels without the full setup.

Description

This feature looks for setups at Internal Liquidity levels (pivots inside the range), not just the extremes.

Configuration Modes

| Mode | Function |

|---|---|

| 1. At POIs |

Only displays setups that occur inside enabled HTF

POIs (OBs, Breakers, FVGs).

Best for confluence. Filters out random liquidity runs. |

| 2. ALL (Aggressive) |

Displays setups at ANY internal pivot, regardless

of trend or POIs.

Shows both trend-following and counter-trend trades. |

| 3. ALL - With Structure | Displays setups at any internal pivot, but ONLY if they align with the HTF Trend (Bullish Structure = Longs only). |

Example: "At POIs" enabled. Setup triggers inside an H12 Order Block.

.png)

Example: "ALL" enabled. Shows setups at every valid pivot sweep.

.png)

Example: "With Structure" enabled. Only trend-aligned setups displayed.

.png)

HTF-LTF Early Warning Systems

How to Configure

- Navigate to Early Warning Systems.

- Choose your trigger: LTF Structure Break and/or LTF FVG.

Description

Early Warning Systems generate a potential setup alert before a HTF SFP is confirmed. This typically allows for an earlier entry but carries higher risk as the HTF candle has not yet closed.

Option 1: LTF Structure Break

Signals if price cuts through a HTF level (Range Extreme/Internal Liquidity) and immediately prints an opposite LTF MSB back through that level.

.png)

Option 2: LTF FVG

Signals if price cuts through a HTF level and prints an opposite LTF FVG back through that level. This is the most aggressive entry, often used for "immediate rebalance" plays.

.png)

LTF -LTF Trade Setups at HTF POIs

How to Configure

- Navigate to LTF-LTF Setups.

- Toggle Enable.

- Select filter: Inside HTF POIs or Confirmed HTF-LTF Signals.

Description

This module looks for LTF SFP + LTF MSB setups that occur specifically within high-probability HTF zones. It's a "fractal" entry model.

Mode 1: Inside HTF POIs

Generates a signal if a LTF SFP + LTF Structure Break occurs anywhere inside an active HTF POI (OB, Breaker, FVG).

.png)

Mode 2: Inside Confirmed HTF-LTF Signals

Generates a signal if a LTF setup occurs inside an already confirmed HTF-LTF Setup (e.g., adding to a winning trade or finding a re-entry).

.png)

Trade Entries and Exits

Trade Entries

How to Configure

- Navigate to Trade Entries.

- Select your LTF Break Type (Trigger).

- Select your Entry Mode (Limit vs Market).

Description

This section controls how the indicator confirms a trade and where it tells you to enter.

.png)

LTF Break Type

How to Configure

- Locate LTF Break Type in settings.

- Choose one of the 6 break types based on your aggression level.

Description

The "Break Type" is the specific price action event on the Lower Timeframe (LTF) that confirms the HTF setup.

| Type | Description |

|---|---|

| 1. MSB (Market Structure Break) |

Standard. Closes through the first opposite pivot

to the left of the SFP candle.

.png)

|

| 2. MSS (Market Structure Shift) |

Sensitive. Closes through the first opposite pivot

to the left OR right of the SFP. Useful for spike

liquidity runs.

.png)

|

| 3. CP (Closest Pivot) |

Aggressive. Uses the absolute closest unbroken

opposite pivot after the SFP.

.png)

|

| 4. Breaker: High/Low |

Uses a candle High/Low break instead of a pivot structure break.

Very aggressive.

.png)

|

| 5. Breaker: Close | Same as High/Low but requires a candle Close beyond the level. Slightly more conservative than H/L. |

| 6. First: Breaker or MSS | The "Hybrid" mode. Triggers on whichever happens first. |

Do not Require SFP

How to Configure

- Navigate to Trade Setups.

- Toggle Do not Require SFP to ON.

Description

For Aggressive Breakouts: When enabled, the system ignores the requirement for a liquidity sweep (SFP). Usually, we want to see price sweep a level and close back (SFP). With this on, if price simply breaks a HTF level and then breaks LTF structure, it signals a trade.

LTF Entry Mode & Require FVG

How to Configure

- Navigate to Trade Entries.

- Select Entry Mode.

- (Optional) Toggle Require FVG.

Description

This determines where the limit order is placed once a setup is confirmed. Using a deeper entry mode (like OB) offers higher Risk:Reward but usually fewer fills.

| Entry Mode | Behavior |

|---|---|

| 1. MSB Level (Standard) |

Limit order placed at the line where structure broke.

Pros: High fill rate. Cons: Lower R:R. .png)

|

| 2. Market Entry |

Enter immediately when the signal candle closes.

Pros: Guaranteed entry. Cons: Worst R:R (loosest stop). .png)

|

| 3. Breaker |

Limit order placed at the LTF Breaker Block.

Pros: Balanced R:R and fill rate. .png)

|

| 4. Order Block (OB) |

Limit order placed at the extreme LTF Order Block.

Pros: Highest R:R (tightest stop). Cons: Lowest fill rate (price may not retrace that deep). .png)

|

Require FVG (Filter)

When enabled, a Valid Setup MUST contain an LTF Fair Value Gap (FVG). If the price move is "clean" with no FVG, the signal is ignored.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)